Jakarta, IO – Being young and educated in 2022 is not easy. For instance, a young guy out of college in his productive age who is currently seeking employment has competition from 3.5 million other “new workers” each year. At least until the “Indonesian demographic bonus” comes to an end, this sustained expansion of the labor force is expected to continue. The issue is that the enormous supply of domestic employees exceeds the capacity of the labor market. Mass layoff reports from businesses in the processing sector have been common for months.

In 2020, during the COVID-19 pandemic’s rough times, big industrial-scale businesses, particularly those in the textile and garment industries, reduced their workforces and implemented harsh efficiency. While some employees were fired without even getting a monthly salary, others were temporarily laid off. According to BPS, a gov’t institution responsible for conducting statistical surveys, Covid-19 affected more than 29.1 million people (14.28 percent) of the population who are working age, including “unemployed due to Covid-19” (2.56 million people), “Non-Working Forces (Bukan Angkatan Kerja) due to Covid-19,” (0.76 million people).

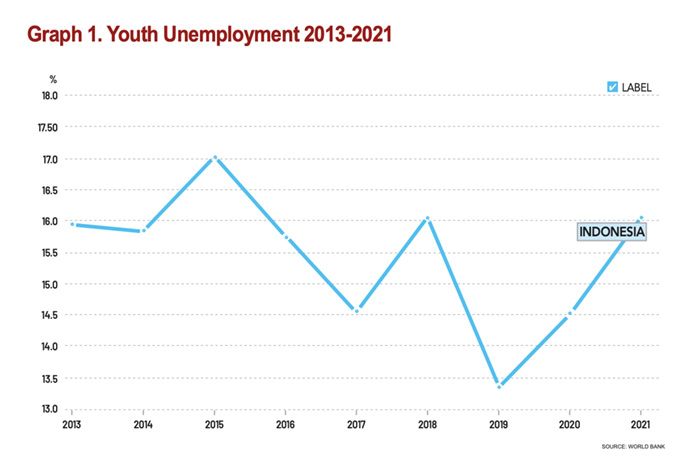

While this is on going , 1.77 million people are “not working owing to Covid-19,” and “working residents who endured a reduction in working hours due to Covid-19” (24.03 million people). According to data from the World Bank, unemployment increased significantly, particularly among young people, who saw an increase to 16% in 2021. Manufacturing sector output either totally ceased or was only 20% of normal capability. (Graph 1. Youth Unemployment 2013-2021)

There is hope that after the pandemic subsides, recovery in the production capacity of textile companies will follow. However, this seems to be fading away. The Ministry of Labor has received reports of layoffs up until September 2022 reaching 10,765 workers. This is contrary to reports of economic growth, which on paper is increasing.

Textile industry near collapse

Giant textile companies actually have suffered from various external factors. Mass layoffs have hit strategic industrial areas such as Karawang and Tangerang. Business owners do not think about recruiting any new employees, but rather how to cut existing employee numbers. The future of the textile and apparel business in Indonesia was bleak even before the onset of the pandemic.

In the last 10 years, the textile and apparel sector, which relies on imports of raw materials, has had to deal with rising import costs. A continuously weakening Rupiah exchange rate even broke through 16,000 per US dollar during the peak of the 2020 crisis, exerting pressure on business actors. Exchange rate stability is not the only driver of rising production costs: there is also disruption in the supply chain. Countries of origin for importing textile raw materials, such as China, are in lockdown and still implementing a “zero-Covid” policy. Delivery of raw materials that incur delays and warehousing costs are borne by textile players.

The competitiveness of textile and apparel companies continues to weaken. The effects of the US-China trade war in the Donald Trump era did not necessarily encourage the relocation of textile factories to Indonesia as a production base. Instead, what happened was the release of international textile brands from Indonesia to other countries. Vietnam, Bangladesh to Ethiopia were considered more promising textile factory relocation destinations than Indonesia. The problem was not because of wages, but because of regulatory uncertainty in Indonesia, which is quite high. For example, the situation after the Constitutional Court’s decision on the Job Creation Law (Omnibus Law), which was considered conditionally unconstitutional.

The factor of competitiveness also comes from the high level of corruption in Indonesia and feeble law enforcement. Logistics costs are still high, setting Indonesia’s ICOR (Incremental Capital Output Ratio) at level 6, up from level 4 just 2 years ago. This signifies investment inefficiency in Indonesia, as it takes an inordinate amount of capital or new investment to produce goods here. (Graph 2. ICOR Indonesia )

Amid the number of graduates of vocational and tertiary institutions who emerge every year, it turns out that a classic “skill gap” problem still occurs: the discrepancy between those skills needed by the manufacturing industry and what the workforce is capable of is very wide. As a result, productivity becomes a serious problem. Companies also need to spend no small amount of money to conduct training for months. This situation implies increased labor costs.

Massive import attacks in various industrial sectors tend to be allowed by the Government. For example, after the pandemic, when news regarding layoff storms in various textile companies emerged, foreign brands actually expanded in shopping centers or malls. The massive opening of clothing sales outlets does not correlate with the increase in local production and employment. If you look at the clothes sold in shops featuring foreign brands, “Made in Bangladesh” or “Made in Vietnam” are the most common.