Jakarta, IO – The recent collapse of Silicon Valley Bank (SVC) has captured the world’s attention, especially economic players in financial, banking and digital sectors. The bank, which served as a source of funding for start-ups and technology companies, was finally shut down after a bank run, when a large group of its panicked depositors withdrew their money at the same time. SVB had grown rapidly in the midst of the Covid-19 pandemic, but failed to quickly adapt to post-pandemic economic reality, marked by the Fed’s rapid, successive benchmark interest rate (Fed Fund Rate/FFR) hikes.

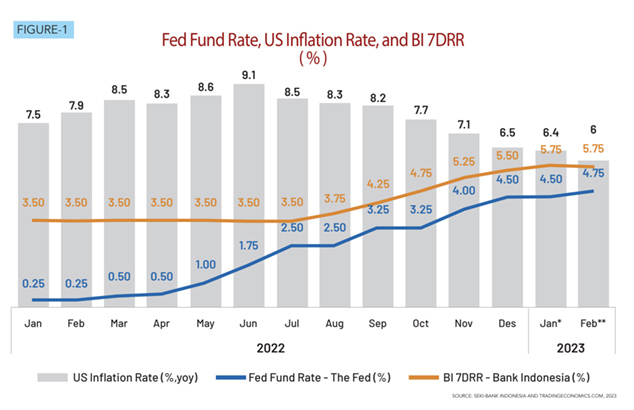

It has long been feared that the Fed’s aggressive monetary policy would exert a major impact on economic stability, not only for the US economy but also the global one. Unfortunately, the Fed has no other option but to raise interest rates, to rein in high inflation in the US in 2022. The Fed’s mandate to control inflation prompted it to announce a series of aggressive rate hikes. The FFR, which was kept very low during the pandemic (at 0.25 percent from 2020 until February 2022) jumped to 0.5 percent in March 2022. It eventually hit 4.75 percent in February 2023 after eight hikes. (FIGURE-1)

A total increase of 450 basis points (bps) or 4.5 percent in just one year, was unprecedented. Of course, the policy risks causing an unanticipated ripple effect across the financial sector. Sure enough, about a year later, the Fed’s hawkish monetary policy has claimed its victims, starting with the collapse of SVB, followed by Signature Bank and First Republic, all medium-sized commercial banks in the US. The global financial world was shaken. Even though they were not as big as Lehman Brothers, which collapsed in 2008, the spectre of the subprime mortgage crisis which sparked the global financial crisis 15 years ago was still too vivid in many people’s minds. This threw depositors at several regional banks in the US into a panic mode.

The “tech winter”

The Covid-19 pandemic, extending from 2020-22, forced people around the world to reduce social interaction. Thus, digital technology, which had been widely adopted, was seen as a bridge to overcome this limitation posed by social distancing rules. The pandemic went on to stimulate rapid development of start-ups and technology companies in various countries. The acceleration of the digital economy that flourished during the pandemic further boosted the future valuation of start-up companies. Unfortunately, as the pandemic has waned in various countries, the global community has returned to pre-pandemic normalcy. The value of start-up companies, which were rocketing during the pandemic, suddenly tanked, because the demand for digital services was not as high post-pandemic. The implication was that many startup companies started to shelve their expansion plans, or conduct initial public offerings (IPO). The prospect suddenly dimmed for them and many were forced to lay off their workers in order to remain competitive amid a scarcity of funding sources. This phenomenon is known colloquially as a “tech winter.”

It was not without reason that the increase in fiscal deficits – financed by sovereign bond issuance – in most countries during the pandemic has caused total global debt to rise sharply, peaking in 2021, hitting nearly US$300 trillion. Many fear that such dangerously high global debt could trigger a debt crisis. On the other hand, digital banks, including SVB, invested a lot of their customer’s savings in government bonds issued during the pandemic.

The composition of SVB’s assets which were concentrated in government bonds was initially considered safe, but as the pandemic ended, excess liquidity from the issuance of these bonds needed to be reduced, because it could trigger inflation. As all countries are currently in an economic recovery phase, and Covid-19 cases remain quite subdued, demonstrating how the pandemic is quickly becoming an afterthought, tight monetary policy (normalization) becomes a necessary measure. However, the US opted to tighten liquidity through aggressive rate hikes, which then led to instability in the global economy. The implication is that as most countries have yet to realize their tight monetary policy plan, it created a widening gap between the rates set by central banks of different countries. As the global economy runs on dollars, the Fed’s moves prompted other countries to also follow suit, to stem massive outflow of foreign capital.

On the other hand, many start-ups have been forced to finance their operations from bank loans, as funding opportunities from venture capital (VC) dwindle because investors prefer to place their funds in banks, which offer more attractive interest rates. The massive withdrawal of deposits impelled SVB to sell cheaply and it even sacrificed the government bonds it held, forcing it to file for bankruptcy. The collapse of SVB, which focused on the start-up sector marks a reversal of fortune for tech companies and may stall the growth of the digital economy in general.